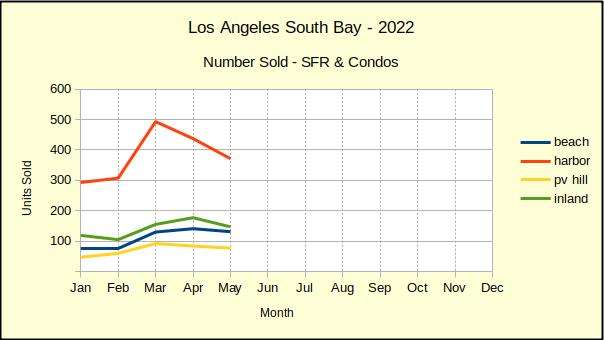

Number of Homes Sold

The number of homes sold in the South Bay has declined from last

month, and has declined from last year. The quantities are actually

rather dramatic given that May is typically a time of increasing sales.

The drops range from -7% to -17% lower than April sales of this year,

and from -17% to -25% below May of last year.

With over half the year remaining, mortgage interest rates have

doubled, currently sitting around 6%. The hike in interest rates has so

far reduced the average buying power by about -25%. Coupled with home

price increases estimated to have risen 38% since the start of the

pandemic, the immediate future of real estate looks dismal.

Inflated consumer prices are also blocking potential home buyers as

the Consumer Price Index (CPI) climbs toward a 10% annual hike. There’s

little chance of saving for a down payment when the price of everything

on the shopping list is going up..

Retirement accounts are often a source of down payment funds. As of

this writing the major stock market indices are all down: Dow Jones

Industrial Average, -16%; S&P 500, -22%; Nasdaq Composite, -31%.

Forecasts are growing for a Fed-induced recession that may begin as soon

as this fall. Some potential buyers may see borrowing from their

retirement fund to purchase a property as a means to preserve the

capital during a recession. Others may not be in a position to do that.

Median Price Sold

May prices delivered a mixed message. The Palos Verdes Peninsula,

which had seen two months of decline from a temporarily high median

price, headed back up again. The Beach cities continued a steady climb,

and the Inland area showed a modest price increase after having dropped

1% in April.

However, the Harbor area, which is as large as the other three areas

combined, took a -6% hit to prices. We anticipate the Harbor and Inland

areas, which comprise the bulk of the traditional middle class family

homes in South Bay, to be the first to react to the economic stress.

Typically, the recession cycle starts with a slowing of sales. As

properties languish on the market, sellers begin to reduce prices. One

after another, median sales prices will drop until the price reduction

offsets the impact to buyers. At that point, buyers will begin to

support the reduced purchase prices and we can see growth in the market.

Experts differ in their estimates of how long this cycle will take,

and when we can expect the market bottom. There are some predicting a

rapid fall based on the speed with which the Federal Reserve Bank (Fed)

is reacting. The June meeting of the Fed ended with a .75% hike in the

prime rate, and a promise to raise it at least another .75% before the

end of the year. While that could slow the economy as early as the

beginning of 2023, more conservative minds suggest the end of 2023 for a

turn-around.

Area Sales Dollars

The total sales dollars tell the truest story. While sales are

slowing and median prices are beginning to slow, the combination shows

up here.

Everywhere except the Beach is showing reductions in total sales on a

month to month basis, and on a year over year basis. The declines are

small to date, with year over year ranging from -1% to -10% in May.

Month to month changes ranged from +2% at the Beach to -19% in the

Harbor area.

These early numbers follow the general pattern we’ve seen in recent

recessions, whereby entry level homes are the first impacted and the

last to recover. We anticipate the Harbor area to lead the charge down,

followed by the Inland area. Recent years have shown the Beach to be

the strongest growth area, so we expect the recession to hit there last,

following declines on the Hill.

The nature of the impending recession is still uncertain. Some

pundits are saying that at least initially we should expect

“stagflation,” that odd environment we first encountered back in the

1990s when prices of everything continued to climb, along with job

layoffs and massive unemployment. Other forecasters suggest that because

the international economy is roiling with continuing high tariffs

(courtesy of the last administration) and new monetary sanctions daily

(courtesy of the current administration), this particular recession may

last much longer than normal.

In Summary

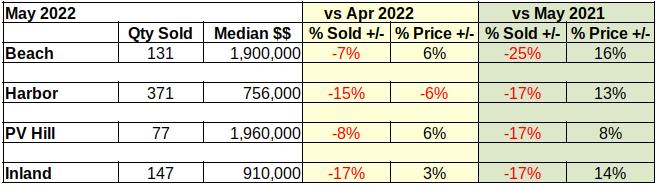

As the table below shows, the majority of the negative impact for May

happened in the quantity of housing units sold. With one exception,

prices continued to escalate. We believe this is temporary and likely to

change before the end of the year. The -6% drop in median price at the

Harbor presages the direction of home pricing as inventory grows and

listings stagnate.

Approximately 3 out of 4 listings coming across our desk recently

have been either Price Reduction or Back On Market. That means property

is staying on the market longer. The Average Days On Market (DOM) for

May ranged from 10 days on the PV Hill to 14 days in the Harbor area. As

recently as this winter we were still seeing multiple offers on the

first day the property was available.

Another measure of the market condition is how far the average sales

price declines in the first 30 days on market. We did a quick look for

May and came up with these statistics. Thirty days after the original

listing, the price had dropped from the original: at the Beach, -9%; the

Harbor -6%; PV Hill -18%; Inland -5%. As of May, we’re also seeing

property that has been on the market for several months, with several

price reductions.

Notable Properties

The high and low sales for May were not terribly dramatic. A

Manhattan Hill section home and a downtown Long Beach condominium. Thay

are simply very big, and very small.

High Sale

Located at 812 5th St, this Manhattan Beach hill section home was

originally listed at $10.5M and sold for $8,980,000 after 34 days active

on the market. The home offers six bedrooms and seven full bathrooms in

5576 sq ft. Amenities included ocean view, pool, spa, custom waterfall

& fire features, a full basement with recreation/media room, home

theater, storage, a temperature-controlled wine cellar, and private

guest quarters.

Low Sale

Measuring barely 381 sq ft, the studio condo at 819 E 4th St #25 sold

for $215,000 in one day. Located in the vibrant East Village of

Downtown Long Beach this tiny home offers a remodelled kitchen and

bathroom. The unit sits on the second floor, overlooking the

intersection of 4th and Alimitos and within walking distance of many

downtown shops, clubs and eateries.

Main photo by Kostiantyn Li on Unsplash